As an Amazon Associate, we earn from qualifying purchases. Some links may be affiliate links at no extra cost to you. Although our opinions are based on curated research, we haven't used these products. Articles generated with AI.

3 Best Surfing Travel Insurance Policies to Keep You Safe on Your Next Adventure

When choosing the best surfing travel insurance, consider policies that cover surfing injuries, equipment losses, medical evacuations, and trip cancellations. Look for options with 24/7 emergency hotlines and coverage for pre-existing conditions. Make certain your policy provides financial protection for lost or damaged gear, with transit coverage for your surfboard. It’s also essential to review any exclusions related to professional competitions or high-risk activities. To discover specific policy recommendations, continue exploring your options.

Key Takeaways

- Look for policies that specifically cover surfing-related injuries, including fractures and concussions, to ensure comprehensive protection during your adventures.

- Choose insurance that includes coverage for lost or damaged surfing equipment, such as surfboards and wetsuits, to avoid unexpected costs.

- Ensure the policy provides emergency medical evacuation coverage, especially if you plan to surf in remote or hazardous locations.

- Review trip cancellation protections to safeguard your investment against unforeseen events that may disrupt your surfing plans.

- Confirm liability coverage is included to protect against accidental injuries or damage to property while surfing.

Life and Health Insurance License Exam Prep Book

Life and Health Insurance License Exam Prep: The Straight-to-the-Point Training Book, with 10...

- Scott, Adam James (Author)

- English (Publication Language)

- 139 Pages - 11/19/2023 (Publication Date) - Independently published (Publisher)

If you’re preparing for the life and health insurance license exam, the “Life and Health Insurance License Exam Prep Book” is an excellent choice for you. This extensive resource simplifies complex terms and concepts, making it accessible even for beginners. It features ten complete practice tests and offers various study methods, including flashcards and video resources.

Many users appreciate the clarity of terminology, but some have raised concerns about the accuracy of specific content, particularly regarding annuities. Although it may not be the most exhaustive guide compared to others, it provides a solid foundation for your exam preparation.

Best For: Individuals preparing for the life and health insurance license exam who are looking for a beginner-friendly resource with practice tests.

Pros:

- Simplifies complex insurance terminology, making it accessible for beginners.

- Includes ten complete and up-to-date practice tests to reinforce learning.

- Offers diverse study methods, such as flashcards and supplementary video resources.

Cons:

- Some inaccuracies in terminology and explanations, particularly regarding annuities.

- May not be as comprehensive as other study guides, like Exam FX.

- Users may require additional external reading to fully grasp certain concepts.

Glove Box Compartment Organizer – Car Document Holder

Glove Box Compartment Organizer - Car Document Holder - Owner Manual Case Pouch - Vehicle Storage...

- PERFECT SIZE - The size of this car document case was designed to fit most glove box compartments, larger car or truck consoles, and door pockets. Fits all your important...

- CONVENIENT ORGANIZATION - This glove box console organizer features five interior pockets for service and car user manuals, repair receipts, maps, registration and...

- AUTO LOG BOOK & PEN TIRE GAUGE INCLUDED - We are including an easy to use Car Log Book, includes 4 categories (Fuel Log, Trip Log, Maintenance & Repairs, and Notes). A...

The Glove Box Compartment Organizer is an essential tool for anyone looking to keep their car documents neatly arranged and easily accessible. This car document holder, made by PlusXpres, features a durable gray polyester construction that’s scratch and tear-resistant. Measuring 9D x 6.5W x 1H inches, it easily fits in your glove compartment or larger consoles.

Storage Features

- Main Pocket: Holds owner manuals up to 8.3” x 6”.

- Pockets:

- Five for service manuals, receipts, and registration.

- Eight for credit or business cards.

- One clear pocket for ID.

- Quick Access Pocket: Ideal for coupons and parking change.

Included Accessories

- Auto Log Book: Track fuel, trips, and maintenance.

- Tire Gauge: Measure tire pressure accurately.

This organizer keeps everything in place, protecting documents from damage while allowing easy access when you need it.

Best For: Individuals seeking an organized solution for storing and accessing car documents efficiently while on the road.

Pros:

- Durable construction made from scratch and tear-resistant polyester.

- Ample storage with multiple pockets for various documents and cards.

- Includes handy accessories like an auto log book and tire gauge for added convenience.

Cons:

- Some users find the pocket sizes may be slightly smaller than standard document sizes.

- Occasional complaints about seam durability over time.

- Limited color options, only available in gray.

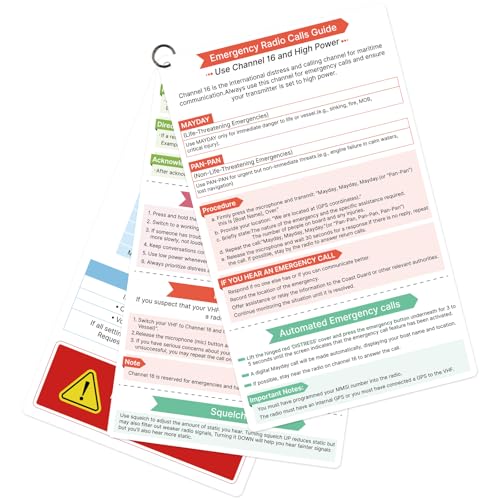

VHF Marine Radio Quick Guide Safety Kit (3pcs)

OCQOTAT Quick Guide for VHF Marine Radio-heavy plastic card,Handy Boating Must Haves,Boat...

- All-in-One Marine VHF Radio Reference:Cover every essential topic for clear VHF radio marine communication: Spelling Alphabet, Channel Usage, Emergency & Safety Calls,...

- Durable & Waterproof Plastic Card for Boat Safety:Built to withstand harsh marine conditions, this heavy-duty plastic card is waterproof, tear-resistant, and easy to...

- Quick Access with Metal Ring – Perfect for Boat Accessories:Includes a sturdy metal ring for convenient storage near your boat radio. Bright colors and bold headings...

A key feature of the VHF Marine Radio Quick Guide Safety Kit is its thorough reference material, designed specifically for mariners and their crews. This kit includes essential topics like the Spelling Alphabet, Channel Usage, Emergency Calls, and Weather Broadcasts.

Durable and Portable Design

Each of the three double-sided plastic cards measures 9 x 5.5 inches, making them easy to read and store. Their waterproof and tear-resistant material guarantees longevity, while the sturdy metal ring allows for quick access.

Essential Boating Accessory

This kit is ideal for all boaters, offering crucial information for effective VHF communication and enhancing safety during your adventures.

Best For: This VHF Marine Radio Quick Guide Safety Kit is best for mariners and boating enthusiasts seeking clear communication and safety guidance while on the water.

Pros:

- Durable & Waterproof: Made from heavy-duty plastic that resists water and tearing, ensuring longevity in marine conditions.

- Quick Access Design: Features a sturdy metal ring and bright colors for easy reference without the need to flip through manuals.

- Comprehensive Information: Covers essential topics such as emergency procedures, channel usage, and weather broadcasts, enhancing safety and preparedness.

Cons:

- No Warranty Information: Lacks specific warranty details, which may concern some buyers regarding long-term durability.

- Limited to VHF Communication: Focused solely on VHF marine radio, which may not cover all communication needs for diverse boating scenarios.

- Size May Be Inconvenient for Small Boats: While portable, the cards’ size might be cumbersome for very small vessels with limited storage space.

Factors to Consider When Choosing Surfing Travel Insurance

When choosing surfing travel insurance, it’s essential to take into account several key factors. You’ll want to make sure your policy covers surfing activities, provides medical emergency assistance, and includes trip cancellation protection. Additionally, think about equipment loss or damage coverage and any location-specific factors that may apply to your surfing destination.

Coverage for Surfing Activities

Choosing the right surfing travel insurance is essential for your safety and peace of mind while enjoying the waves. Make sure your policy includes coverage for injuries, such as fractures or concussions, as standard insurance often excludes high-risk activities.

Look for policies that cover equipment damage or loss, protecting your surfboards and wetsuits. It’s also important to have coverage for emergency medical evacuation, especially if you’re surfing in remote locations.

Additionally, review the policy for trip cancellations or interruptions due to weather conditions, like storms that prevent surfing. Finally, check if the insurance includes liability coverage in case you accidentally injure another surfer or damage property while surfing.

Medical Emergency Assistance

Selecting the right medical emergency assistance is essential for surfers who want to guarantee swift and effective care while traveling. Look for policies that include coverage for hospital stays, surgeries, and emergency medical transportation.

Key features to take into account:

- 24/7 Emergency Hotline: Many plans offer immediate access to medical advice in case of a surfing injury.

- Pre-existing Conditions: Check if the policy covers pre-existing conditions, as some may impose restrictions.

- Repatriation: Coverage for repatriation ensures you can return home for treatment if needed.

- Surf-related Injuries: Confirm that your insurance specifically covers surf-related injuries, as some policies might exclude high-risk activities.

Thoroughly review these aspects to guarantee you’re fully protected.

Trip Cancellation Protection

Trip cancellation protection plays an essential role in safeguarding your investment when planning a surfing trip. This coverage reimburses non-refundable expenses if unexpected events like illness, injury, or extreme weather force you to cancel.

When selecting a policy, review the terms carefully to guarantee it covers surfing-related activities. Coverage typically ranges from 50% to 100% of your total trip cost, depending on the policy. Some insurers offer “cancel for any reason” (CFAR) options, allowing you to cancel for reasons not usually covered, but these often require prompt purchase after booking.

To maximize your coverage, it’s advisable to buy trip cancellation insurance as soon as you finalize your trip, as many policies include time-sensitive clauses.

Equipment Loss or Damage

When planning your surfing adventure, guaranteeing your equipment is protected from loss or damage is essential. Equipment loss or damage coverage in travel insurance safeguards you against financial losses from stolen, lost, or damaged surfing gear. This coverage allows you to replace your equipment without significant out-of-pocket costs.

When choosing a policy, consider the following:

- Value Declaration: Accurately declare your gear’s value, as many policies have limits.

- Repair and Replacement: Confirm the policy covers repairs or replacements for surfboards, wetsuits, and other essentials.

- Transit Coverage: Check for coverage during transit, as some insurers may have specific exclusions.

- Policy Details: Read the fine print for deductibles and proof of ownership requirements for claims.

Location-Specific Considerations

Understanding the unique factors of your surfing destination is essential for choosing the right travel insurance. First, consider the surfing conditions; certain areas may have riskier waves, reefs, or currents that increase injury chances.

Next, research local regulations regarding insurance coverage, as some countries require specific liability or medical coverage levels. Also, assess the proximity and quality of medical facilities; remote locations might limit emergency care access, necessitating thorough insurance.

Additionally, evaluate the potential for natural disasters like hurricanes or tsunamis, which could affect both your safety and insurance effectiveness. Finally, make sure your policy covers equipment theft or damage, especially in high tourist areas where such risks are elevated.

Policy Exclusions and Limitations

Choosing the right surfing travel insurance means being aware of certain exclusions and limitations that can affect your coverage.

Key Exclusions

- Professional Competitions: Injuries from professional surfing events may not be covered.

- High-Risk Activities: Many policies limit coverage to recreational surfing only, excluding extreme conditions.

- Pre-existing Conditions: If you have prior injuries, standard policies might not cover them.

Equipment Limitations

– Lost or Damaged Gear: Some policies have specific requirements for the storage and transportation of surfboards and equipment.

Geographical Limitations

– Hazardous Locations: Check for exclusions related to surfing in areas known for dangerous conditions or poor medical facilities.

Understanding these factors guarantees you choose the best policy for your surfing adventure.

Duration of Coverage Options

Selecting the right duration of coverage for your surfing travel insurance is essential for ensuring you’re protected throughout your trip. Coverage options typically range from short-term policies for a single trip to long-term plans covering multiple trips over one year.

Consider the following factors:

- Flexibility: Many insurers allow you to extend your coverage if your travel plans change unexpectedly.

- High-Risk Activities: Be aware that some policies may limit coverage duration for surfing, affecting your eligibility for claims.

- Cost: Longer policies often have higher total prices but may offer lower daily rates.

- Annual Multi-Trip Coverage: This option can be economical for frequent surfers, allowing unlimited trips within a year, ensuring continuous protection.

Frequently Asked Questions

Does Surfing Travel Insurance Cover Injuries From Other Water Sports?

Surfing travel insurance typically covers injuries related to surfing, but it may not extend to other water sports. To guarantee you’re protected, read the policy details closely. Look for specific inclusions such as:

- Coverage for Other Activities: Check if activities like snorkeling, diving, or kayaking are included.

- Exclusions: Be aware of any limitations or exclusions that may apply.

Always confirm with your insurance provider to clarify coverage before your trip.

Can I Get Insurance if I’M Not an Experienced Surfer?

Yes, you can. Most travel insurance providers offer coverage for all skill levels, including beginners. When selecting a policy, consider the following:

- Coverage Options: Look for policies that include water sports.

- Exclusions: Check for any restrictions related to experience levels.

- Activity Details: Verify that your specific surfing activities are included.

Don’t let your lack of experience hold you back from securing the right insurance.

Are Pre-Existing Conditions Covered by Surfing Travel Insurance?

When considering surfing travel insurance, it’s essential to check if your pre-existing conditions are covered. Many policies have specific exclusions for these conditions.

- Read the Fine Print: Look for details on coverage limits.

- Declare Conditions: Always inform your insurer about any health issues.

- Consider Options: Some insurers offer coverage for pre-existing conditions at an additional cost.

Ensure you fully understand what’s included before purchasing.

How Do I File a Claim for My Surfing Insurance?

To file a claim for your surfing insurance, follow these steps:

- Gather Documentation: Collect all relevant documents, such as your policy details, receipts, and any incident reports.

- Contact Your Insurer: Reach out to your insurance provider through their claims department via phone or online portal.

- Complete Claim Forms: Fill out the required claim forms accurately and submit them along with your documentation.

- Follow Up: Keep track of your claim status and respond promptly to any requests for additional information.

Is There a Waiting Period Before Coverage Starts?

Yes, there’s usually a waiting period before your coverage starts. This period can vary based on the insurance provider and policy type. Here are some key points to reflect on:

- Typical Duration: Most waiting periods range from 24 hours to 30 days.

- Immediate Coverage: Some policies may offer immediate coverage for specific incidents.

- Check Your Policy: Always review your insurance documents for exact details on waiting periods.